Calculate depreciation on furniture

How to calculate the depreciation expense for year one. This is why there are several ways to calculate depreciation.

Depreciation Formula Calculate Depreciation Expense

The depreciation rate is the annual depreciation amount total depreciable cost.

. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. For 5 years this looks like this. Furniture has a residual value of nothing.

For example say the assets cost was 50000 the salvage value is estimated to be. The calculator should be used as a general guide only. Furniture used by children freestanding.

The original cost of the furniture and the useful life of the furniture. This depreciation calculator will determine the actual cash value of your Leather Furniture using a replacement value and a 20-year lifespan which equates to 02 annual depreciation. In this case the.

There are many variables which can affect an items life expectancy that should be taken into consideration. This depreciation calculator will determine the actual cash value of your Upholstered Furniture using a replacement value and a 10-year lifespan which equates to 01 annual depreciation. Then plug this number.

5 4 3 2 1 14. Accounting for the usage and depreciation of furniture means knowing two things. The straight-line method means you divide the value by its useful life.

To calculate depreciation using this method you start by adding the sum of all the years of useful life. Used furniture is comparable to used underwear. The calculator should be used as a general guide only.

Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful. There are many variables which can affect an items life expectancy that should be taken into consideration. How to Calculate Depreciation.

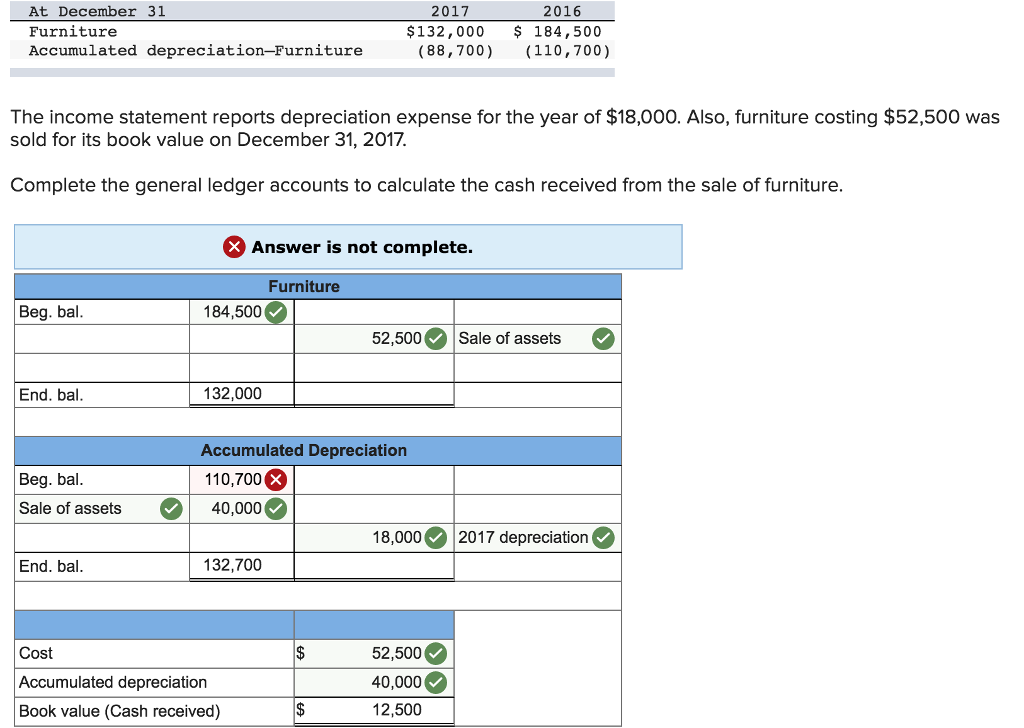

Annual Depreciation Expense Cost of the Asset - Salvage Value Useful Life of the Asset. Furniture depreciation requires three pieces of information to calculate the annual expense associated with this accounting process. Review the calculation for deprecation.

You can use different methods to calculate depreciation. The depreciation rate can also be calculated if the annual depreciation amount is known. Doing this will give you an average depreciation.

For instance a widget-making machine is said to depreciate. Purchase price salvage value and useful life. Age specific including cots changing tables floor sleeping mattresses high and low feeding chairs and stackable beds 5 years.

As mentioned assets like office furniture depreciate at varying rates. It is something that loses its commercial appeal immediately upon possession. Answer 1 of 2.

![]()

Furniture Calculator Splitwise

Depreciation Nonprofit Accounting Basics

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

How To Calculate Depreciation Expense For Business

Assets And Liabilities Spreadsheet Template Balance Sheet Template Spreadsheet Template Balance Sheet

Depreciation Nonprofit Accounting Basics

How To Calculate Depreciation On Furniture Sapling Colorful Interior Design Paint Colors For Living Room Studio Apartment Furniture

Accumulated Depreciation Explained Bench Accounting

Solved At December 31 Furniture Accumulated Chegg Com

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

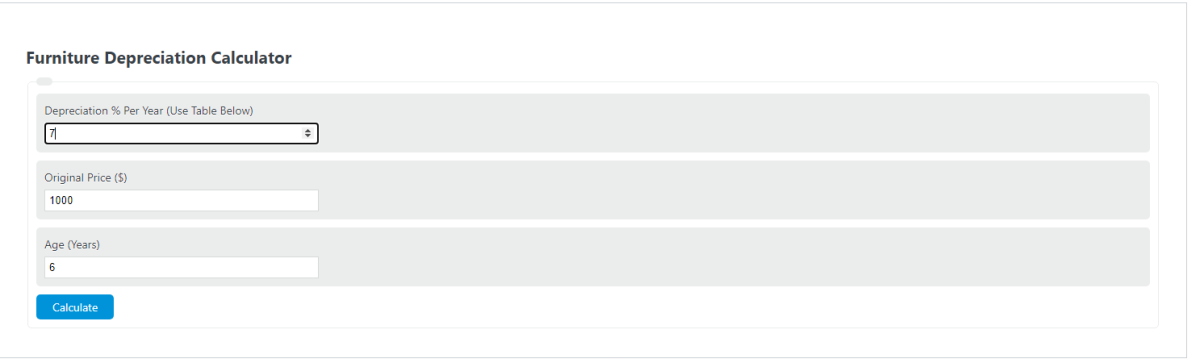

Furniture Depreciation Calculator Calculator Academy

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Small Business Plan Template Financial Statement

Depreciation A Decline In The Value Of Property The Opposite Of Appreciation Real Estate Education Real Estate Marketing Design Real Estate Agent Marketing

Furniture Depreciation Calculator Calculator Academy

How Much Does Furniture Depreciate Ultimate Guide

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

Solved The Following Selected Information Is From Ellerby Chegg Com